A One Thousand Entity Core Financial Services Business Data Model goes open source.

Public License

Jayzed Data Models Inc. has released the core of the Financial Industry Business Data Model (FIB-DM) under GNU General Public License (GPL-3.0), an Open Source Initiative® recommended copyleft license.

The PowerDesigner conceptual model can be downloaded from this website. Other modeling tools can import the native CDM or XMI file. Datamodellers, please follow our LinkedIn page for updates.

FIB-DM Core is a comprehensive, self-contained, high-quality blueprint for smaller financial service providers, academic research, and independent data architects. You can use FIB-DM as a complete Enterprise Data Model, scoped subsets for application and departmental databases, or both.

Comprehensive

With 3,131 normative entities, the Financial Industry Business Data Model derived from 2025/Q1 is the largest Enterprise Data Model available for Banks and Investment Companies.

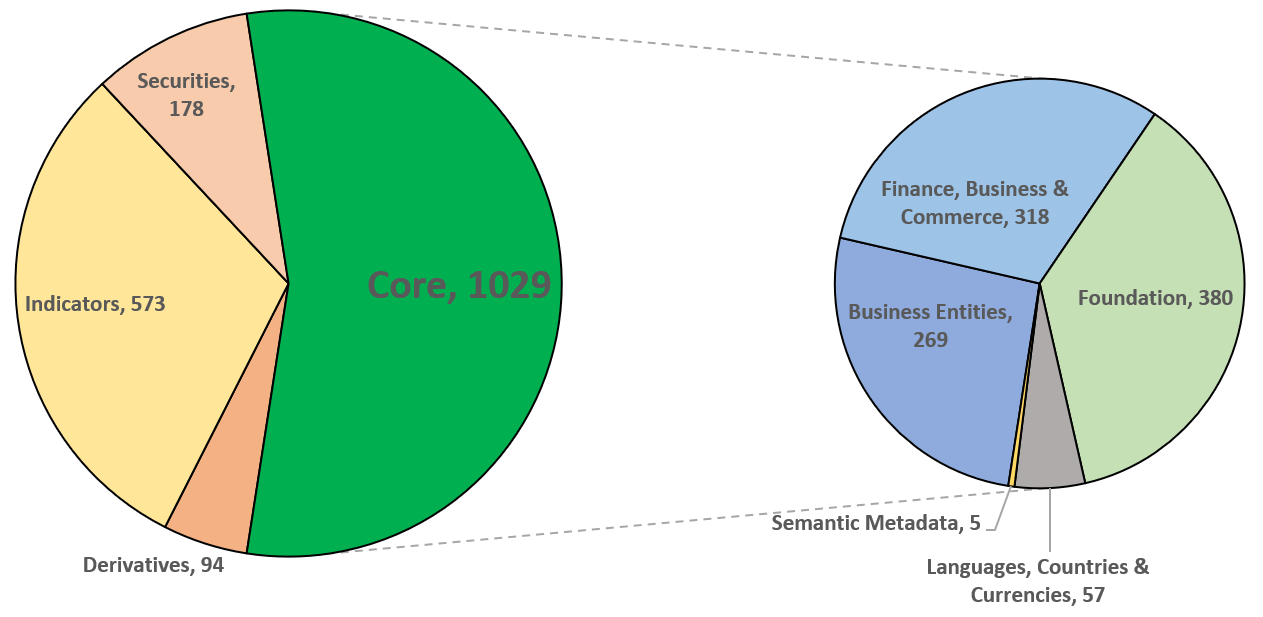

FIB-DM Core, derived from FIBO 2018/Q4 Production, offers 1029 entities for free—a third of the full model.

Jayzed Data Models retains specialized packages for Loans, Securities, Derivatives (DER), Indices and Indicators, Collective Investment Vehicles (funds), and Corporate Actions. Commercial licenses of the extensions fund the work for the open-source core.

Self-contained

FIB-DM is a transformation from the industry-standard ontology. In Set Theory, the core model is a definable inner model of the universe of sets (Wiki). Likewise, an ontology module is self-contained if (SPARQL) queries on the module return the same results as queries on the whole ontology. In other words, there must be no open ends.

The diagram shows FIB-DM main package (subject area) dependencies, which correspond to ontology imports in the reference ontology.

The Foundation (FND) package uses entities from the generic packages for Metadata (SM), Languages, Countries, and Currencies (LCC), and classification, taxonomies, and vocabularies (SKOS). These packages provide the framework of the data model. For the most part, the Foundation package is not Finance-specific. You can use the data model patterns for any domain model. Business Entities (BE) and Finance, Business & Commerce (FBC) extend the Foundation. Most BE and FBC entities are subtypes of Foundation entities. You can leverage half of the content in these packages for other domains.

FIB-DM Core does not refer to the Full model Loans or the Capital Market and Investment packages for Securities, Derivatives, Indicators, Market Data, etc.

The OMG Commons ontology was added to the FIBO in 2023, and FIB-DM Core does not depend on the derived complete version package.

High-quality, concise, and business-friendly design

FIB-DM is a complete model transformation of FIBO, the Financial Industry Business Ontology. The ontology was created by the Enterprise Data Management Council (EDMC), an association of global financial institutions. Hence, FIBO is the authoritative open-source industry standard for concepts, their relationships, and definitions.

But since the Ontology Web Language (OWL) fundamentally differs from the Entity-Relationship Model (ERM), won’t the design also need to be changed?

No, there is a one-to-one correspondence between named OWL classes and data model entities because both classes and entities define the same business concepts.

The example diagram below shows the FIB-DM Foundation Agreements Contracts sub-package. For clarity, Associative entities are blue throughout all diagrams.

A contract has effective and execution dates, various terms, and contract parties. Note that in FIBO and FIB-DM, the party is the role that a person or legal entity plays in the context of the contract.

Data modelers will notice the Promissory Note’s multiple inheritances—they are not a bug but a feature.

- The Promissory Note is a Written and Unilateral Contract for the business user.

- FIB-DM is a conceptual data model that will not be physicalized.

- After scoping and attribution, the modeler will determine the appropriate pattern to resolve the inheritance.

The Transformation White Paper explains configuration decisions and intricacies in detail.

Conclusion

FIB-DM Core is a comprehensive, self-contained, high-quality blueprint for financial service providers. You can use the largest open-source data model at the Enterprise level or pattern library Application DB design.

References and further reading

Learn more and upgrade to the Full Data Model, the commercial version, here.

FIB-DM page on the EDM Council website: https://spec.edmcouncil.org/fibo/page/data-model

Open Source Initiative website: https://opensource.org/

Jayzed Data Models website: https://fib-dm.com/

FIB-DM Technical Specification, Whitepaper, and Diagrams: https://fib-dm.com/

The OSI logo trademark is the trademark of the Open Source Initiative.