This article presents the benefits of the full commercial over the core open-source version.

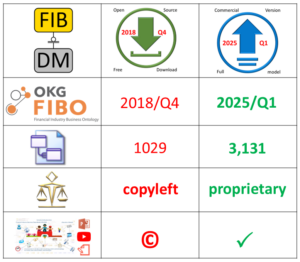

FIB-DM Normative, the industry standard derived from FIBO 2025-Q1 Production, comprises 3,131 entities.

The full version adds 2,000 normative entities in additional packages for Loans, Securities, Derivatives, Indices and Indicators, and Corporate Actions. The permissive commercial license includes data model resources. This overview discusses license terms, maintenance, and pricing.

Audience

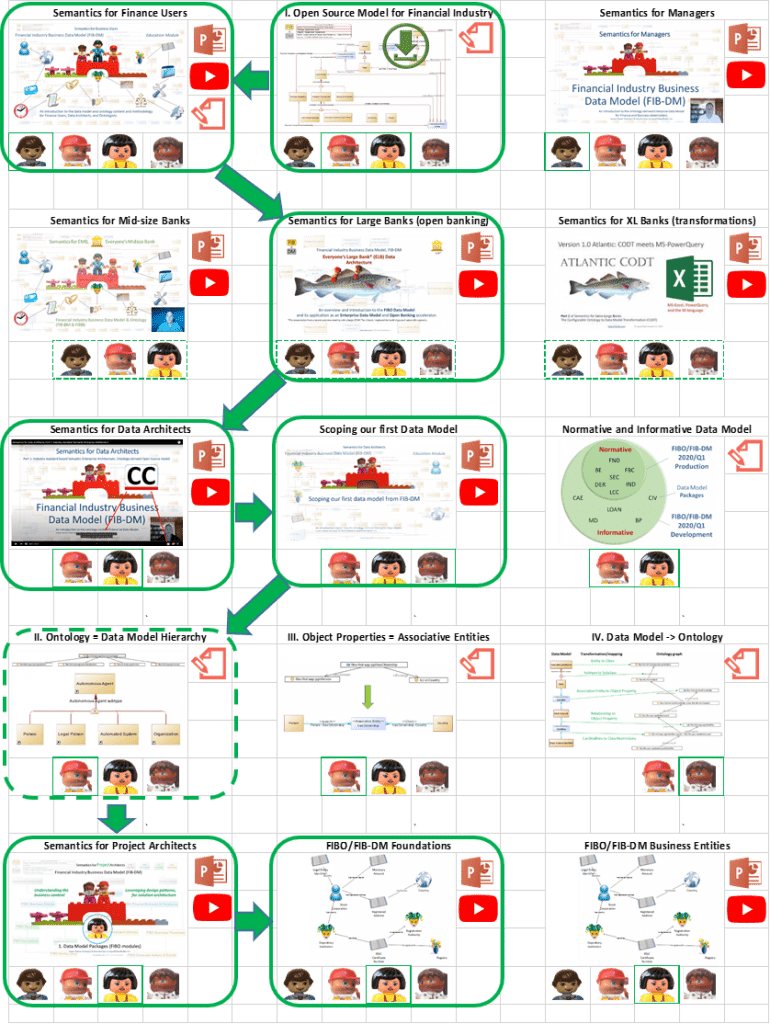

The FIB-DM extended overview is designed for technical and business users, as well as decision-makers.

As a data architect, you are already evaluating the Open-Source Version. You downloaded the FIB-DM core and, if not on PowerDesigner, imported the model file into your data modeling tool. Now, you want to unlock the additional packages and entities of the extended version.

As an ontologist, business analyst, or finance user, you embrace the FIBO concepts, definitions, and FIB-Concept maps. You want to fully utilize the MS Excel, PowerPoint, and Visio model resources.

As a decision-maker, your team requests an upgrade to the FIBO data model. You want to align with the industry standard, but you must fully understand license terms and ownership costs.

FIB-DM extended vs. core

FIB-DM Core is a comprehensive, self-contained, high-quality blueprint for smaller financial service providers, academic research, and independent data architects. More than 3,500 users from 109 countries have downloaded the free version, which is released under the GNU General Public License (GPL-3.0), a license recommended by the Open Source Initiative.

The commercial version unlocks more than 2000 normative entities in eight Banking and Investment Management packages.

Data Model Resources

A colossal data model can be overwhelming. New users need an introduction, training materials, and references. As a bonus, the commercial license grants unrestricted permission to copy, edit, lift off, and even rebrand the extensive FIBO data model resources for internal use.

- 100 Entity Relationship Diagrams in SAP PowerDesigner and Scalable Vector Graphics (SVG)

- 170 pages of educational courseware in MS PowerPoint

- 6 hours of webinar videos

- 50 pages in articles & whitepapers

- MS-Excel reports, MS-Visio stencils, and templates

The public Diagrams and Resources are found on the FIB-DM website’s main menu. Open-source users can view presentations and reports in MS Office online and download PDFs.

Commercial Licensees receive a ZIP file with data model resources, or download the original MS Office files on the Jayzed FIB-DM Support Portal. You are encouraged to edit, translate, and reformat the materials as your organization’s training materials. The only restriction is that you can’t pass them on to third parties.

License Agreement

The agreement is a standard commercial license for intellectual property. The Jayzed Data Models IPLA defines organization (you), intellectual property, information model (the FIB-DM), Derived Work, and Distribution.

“Derived Work” is any work based upon the data model. It can be Modifications (e.g., scoping, adding entities) or secondary works (migrating the model or generating a physical model). You own the title to the derived works you create, but can not distribute them to third parties.

You must retain the EDM Council, Object Management Group, or Jayzed copyright and license notices on the model and derived works. Treat the FIBO data model the same way you would the original ontology.

For bona fide distributions, you can request a waiver free of charge. For example, collaborating with other licensed Financial Institutions or publishing your presentations based on model resources.

| Topic | Detail | Your current General Public License 3.0 | Your upgrade Commercial License |

|---|---|---|---|

| FIBO Release | 2018/Q4 | 2025/Q1 | |

| Domain | Public | Private | |

| Distribution | Original FIB-DM | encouraged | prohibited |

| Your FIB-DM derived works | Open Source | Private, not applicable | |

| Number of Entities | 1029 | 3,131 | |

| Object Management Group | OMG Commons | X | ✔ |

| FIBO Modules | Foundation | ✔ | ✔ |

| Business Entities | ✔ | ✔ | |

| Finance, Business & Commerce | ✔ | ✔ | |

| Securities | X | ✔ | |

| Derivatives | X | ✔ | |

| Indexes & Indicators | X | ✔ | |

| LOANS | X | ✔ | |

| Funds | X | ✔ | |

| Corporate Actions | X | ✔ | |

| Market Data | X | ✔ | |

| Business Processes | X | ✔ | |

| Resources | PowerPoints | X | ✔ |

| Videos | X | ✔ | |

| Whitepapers | X | ✔ |

In summary, the Open-Source license requires you to copyleft, which means licensing your derived models to the public.

The proprietary Customer commercial license agreement waives the requirement of the GPL 3.0 license. In other words, you keep your FIB-DM Enterprise and other models secret.

Likewise

With a customer license, you can modify, translate, edit, and even lift off images and diagrams as long as they remain within your organization.

Maintenance

There is no official release plan for the Financial Industry Business Ontology. Finalizing the Development modules, rigorous review, and QA depend on EDMC members’ availability to provide subject matter experts.

The EDM Council releases new FIBO Production and Development versions every quarter.

FIB-DM follows the schedule and has a new data model version four weeks after the new FIBO release.

The optional maintenance contract, in addition to support, entitles you to twelve months of free upgrades. You can also download new and updated resources on the portal.

Pricing

Licenses are priced for institution size, using your EDMC membership tier as a segment.

| Line of Business | Metric | Tier A | Tier B | Tier C |

| Sell Side | Consolidated Capital | $10B+ | $500M-$10B | <$500M |

| Buy-Side | Assets under Management | $200B+ | $50B-$200B | <$50B |

| Custody | Assets under Custody | $1,000B+ | $100B-$1,000B | <$100B |

The license price for a mid-tier Financial Institution is $59,000—a fraction of the competing vendor’s industry data models. Central Banks, Multilateral Lenders, and other qualifying financial institutions get the Tier C price, irrespective of asset size.

The optional 12-month maintenance contract costs 20% of the license price, for example, $10,000 per year for a Tier B financial institution.

Note: The above prices are indicative. They will rise as the model grows. Please always request a quote.

Conclusion: Upgrade now

- Update to the latest 2025/Q1 FIBO release.

- Unlock the whole data model.

- Keep your derived works proprietary.

- Fully leverage the education resources.

References

Specification of the offer: FIB-DM 2025/Q1 Normative Entity list report.

Template Jayzed Intellectual Property License Agreement (IPLA).

Find your EDMC membership tier or balance sheet and receive a formal quote. Contact us with any questions or to arrange a meeting. Thanks!

Jurgen Ziemer, Jayzed Data Models, Inc., jziemer@jayzed.com